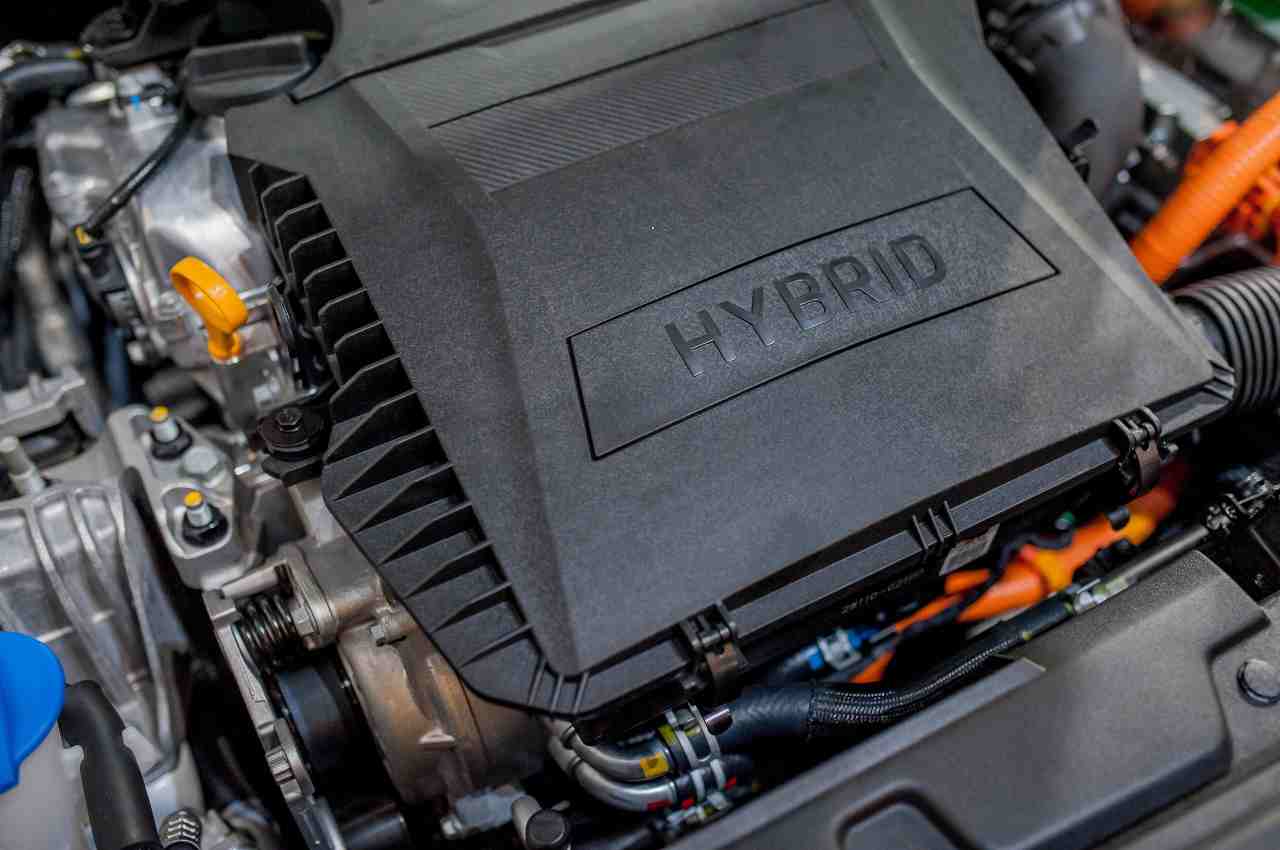

Yellow flames warn: If you have a hybrid car, you may be subject to more controls.

Whoever owns a hybrid is so rich that he appears as a wealthier taxpayer than others. However, not all hybrid or electric cars are indicators of wealth.

In addition to this first point, the General Command of the Financial Police has ordered more detailed checks also on people who sell alcohol.

The reasons are the same as owning a hybrid car, also in this case certain categories of alcohol are excluded.

Let’s find out more about the provisions made by the General Command of Yellow Fire to the individual orders of the Financial Police, and let’s see which specific subjects, among the general categories just mentioned, are targeted by the tax authorities in the checks that will start from 2023.

If you’ve got a hybrid car, checks are running out: Now’s the time

As expected at first, owning a hybrid car is itself an indicator of ability to drive.

However, not all hybrid cars must be considered as such, also because the main checks are triggered if the vehicle owned has a power equal to or greater than 120 kW.

On the other hand, if you own an electric car, the checks will start when its power is over 70 kW.

Vehicle power should be understood as “maximum net power”, and the vehicles targeted by the tax authorities are those registered in the three years preceding the inspection.

These evaluation criteria will take effect on January 1, 2023.

Also check those who sell alcohol

Even those who sold alcoholic beverages, with the exception of beer and wine, would be richer than the average taxpayer.

For these types of traders, checks will be made through Re.Te Telematic record of accounting data.

It is used to collect all accounting data from cash registers.

The registry has replaced paper records, and information transmitted electronically is legally valid from a financial point of view.

Furthermore, it is final and will constitute the Statement of Dispute.

So these are the categories of people who will have to be careful with their tax returns, as well as with their tax payments.

The very fact of owning a hybrid car with so much power would, in fact, be an indication of the ability to drive. In the same way, those who sell alcohol other than beer and wine will be considered.

“Explorer. Devoted travel specialist. Web expert. Organizer. Social media geek. Coffee enthusiast. Extreme troublemaker. Food trailblazer. Total bacon buff.”